Join Forward-thinking Leaders

Elevate your expertise with tech insights, startup breakthroughs, and leadership intelligence curated for your priorities.

Elevate your expertise with tech insights, startup breakthroughs, and leadership intelligence curated for your priorities.

Subscribe to our newsletter!

Rapid Commerce Unicorn Zepto is pushing back its initial public offering (IPO) plans by a year, now intending to enter the public markets in calendar year 2026, according to persons familiar with this latest startup news.

Summary:

1. Zepto, a rapid commerce unicorn, is rethinking its IPO plans, aiming to enter the public markets in 2026.

2. The company is dealing with increased fixed costs, operational challenges, and a drop in Swiggy’s share price, which has fallen by 38% year to date.

3. Despite the pushed IPO date, it is close to completing its IPO syndicate and hiring additional bankers, including JM Financial and Motilal Oswal, along with Goldman Sachs, Morgan Stanley, and Axis Capital.

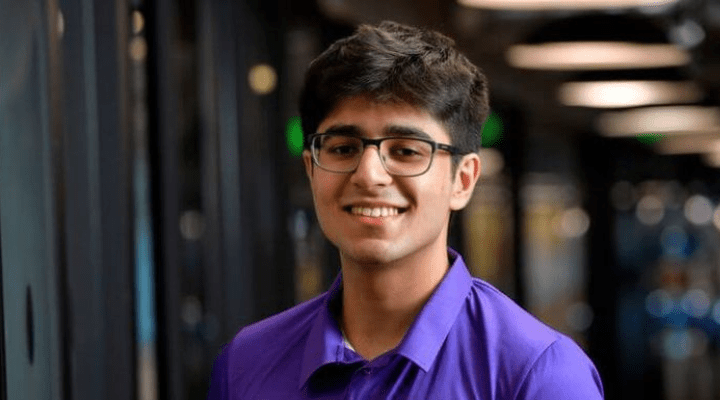

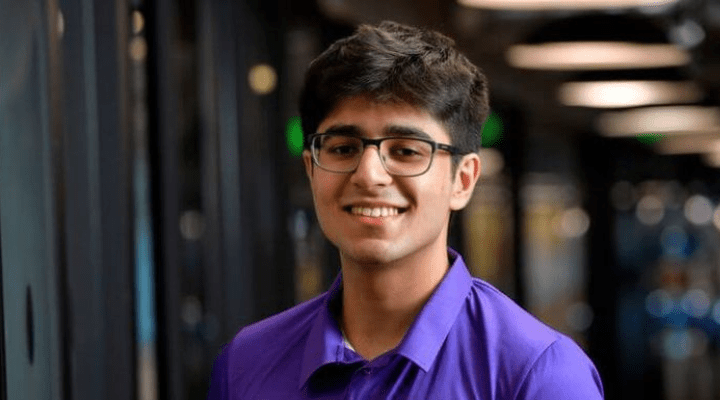

Aadit Palicha, Zepto’s chief executive officer and co-founder, had said in media reports that the company was certain of going public in 2025.

“That’s our ambition…of course, capital markets can change, but for now, we’re optimistic that if the business manages to perform well, we’ll go public in calendar 2025,” Palicha told media agencies in an interview at the end of 2024.

However, Zepto will not IPO this year, even if it files a draft red herring prospectus (DRHP) in the next months, according to sources.

“The idea has been put back a few months on different occasions. However, it is now almost inevitable that the e-commerce platform will not IPO this year as it seeks to reduce capital burn while enhancing its profit profile,” based on the sources.

According to the sources, the loss figure roughly doubled between November and January-February as the company responded to a fiercely competitive industry dominated by Eternal’s Blinkit and Swiggy’s Instamart.

Rapid commerce unicorn has also been dealing with increased fixed costs. Its employee salary bills total around Rs 100 crore every month, which is roughly 80-90 percent of rival Swiggy and 60 percent of Eternal (Zomato), while having half the workforce, Moneycontrol previously reported exclusively.

Also Read: Zero Networks Has Secured $55 Million in Private Funding

Palicha is also dealing with other operational challenges.

Zepto Cafe has halted operations in 44 outlets across the Delhi NCR belt and surrounding areas. Aside from that, the company is dealing with a warning from the Maharashtra FDA, which has resulted in a suspension of services in Dharavi, and its delivery partners are also striking at several of its Hyderabad locations.

“With those burn numbers, it is known it cannot head for an initial public offering because public market investors will not have the comfort, especially if its rivals are burning much less,” a source informed me.

“Public market investors will want to see profitable growth before investing in the company, especially when they can now benchmark it against listed players like Swiggy and Eternal.”

Internally, CEO Palicha is also hesitant to go public because he has witnessed his competitors’ share values drop. Indeed, Swiggy’s share price has fallen by roughly 38% year to date (YTD), trading at around Rs 333 per share on the National Stock Exchange (NSE) as of June 4.

According to this latest startup news, Swiggy’s market capitalization peaked at over $18 billion and is now valued at roughly $10 billion.

“The better Swiggy and Eternal perform, the higher Zepto’s valuation will be – it’s that simple. Their dropping valuation indicates Zepto will receive a lower-than-expected valuation,” one of the individuals said.

Even though Zepto’s Initial Public Offering date has been pushed back a few months, the company is close to completing its IPO syndicate and hiring additional bankers.

“JM Financial and Motilal Oswal have been added to the IPO syndicate,” a third source informed. According to Moneycontrol, these two names are in addition to Goldman Sachs, Morgan Stanley, and Axis Capital.

Follow The Techrising to stay ahead with the latest stories in startups, tech, so you never miss a breaking story or trending headline.